Introduction

For the first time in U.S. history, betting on elections has become widely accessible within the U.S. thanks to new legal permissions. The D.C. Circuit Court of Appeals recently upheld a ruling that allows Kalshi to offer political betting, creating a legal precedent for similar platforms. However, not all political betting markets are open to U.S. residents. Offshore platforms like Polymarket restrict U.S.-based bettors due to a 2022 CFTC ruling.

Trump’s popularity extended beyond prediction markets, also boosting the stock of the Trump Media and Technology Group, which saw an 8% increase as the election drew closer. Hundreds of his supporters gathered online on platforms like Rumble to celebrate, underscoring the strong backing for the former president and the notable connection between his followers and election bettors.

The Big Players: Polymarket and Kalshi

Two of the largest prediction platforms, Polymarket (crypto-based) and Kalshi (U.S.-regulated), have become central to the election betting landscape. Kalshi and Polymarket have soared to the top of app download charts on the Apple App Store, outpacing even TikTok and Instagram.

Polymarket

For international bettors, Polymarket, a crypto-based offshore exchange, allows for election betting with high liquidity but lacks U.S. regulatory approval. Polymarket allowed wagers right up until major media outlets called the election, with a payout of approximately $287 million.

Kalshi

Kalshi, a regulated U.S.-based prediction market founded in 2018, gained temporary court approval in October 2024 to offer presidential betting. This approval came despite ongoing disputes with the Commodity Futures Trading Commission (CFTC). In total, Kalshi said 28,000 people had made bets on a Harris win, while 40,000 bet on Trump.

“I think we’re gunning for No. 1 for the entire App Store by Election Day, so the demand curve truly is exponential.” – Tarek Mansour, CEO of Kalshi

Kalshi, which allows betting up until Inauguration Day in January 2025, saw a payout pot of around $159 million.

Some platforms, including PredictIt, are still navigating legal challenges, with the Commodity Futures Trading Commission (CFTC) pushing for more regulations to protect the integrity of the democratic process.

The CFTC is pushing to restrict election betting further, with a proposed rule that would ban contracts based on outcomes of public events, including elections. If passed, platforms like Kalshi may face additional legal challenges to continue offering political betting.

Key Takeaways

- Kalshi and Polymarket became the most downloaded free apps on the Apple App Store on Tuesday.

- Kalshi is available to U.S. citizens, while Polymarket is used by international bettors.

- These betting markets account for factors like media coverage and breaking news, offering dynamic forecasts that can sometimes be more accurate than static polls.

Future Prospectus

As the 2024 election approaches, platforms are expanding their offerings, with options to bet on margins of victory in battleground states and even on figures like Elon Musk potentially joining the presidential cabinet.

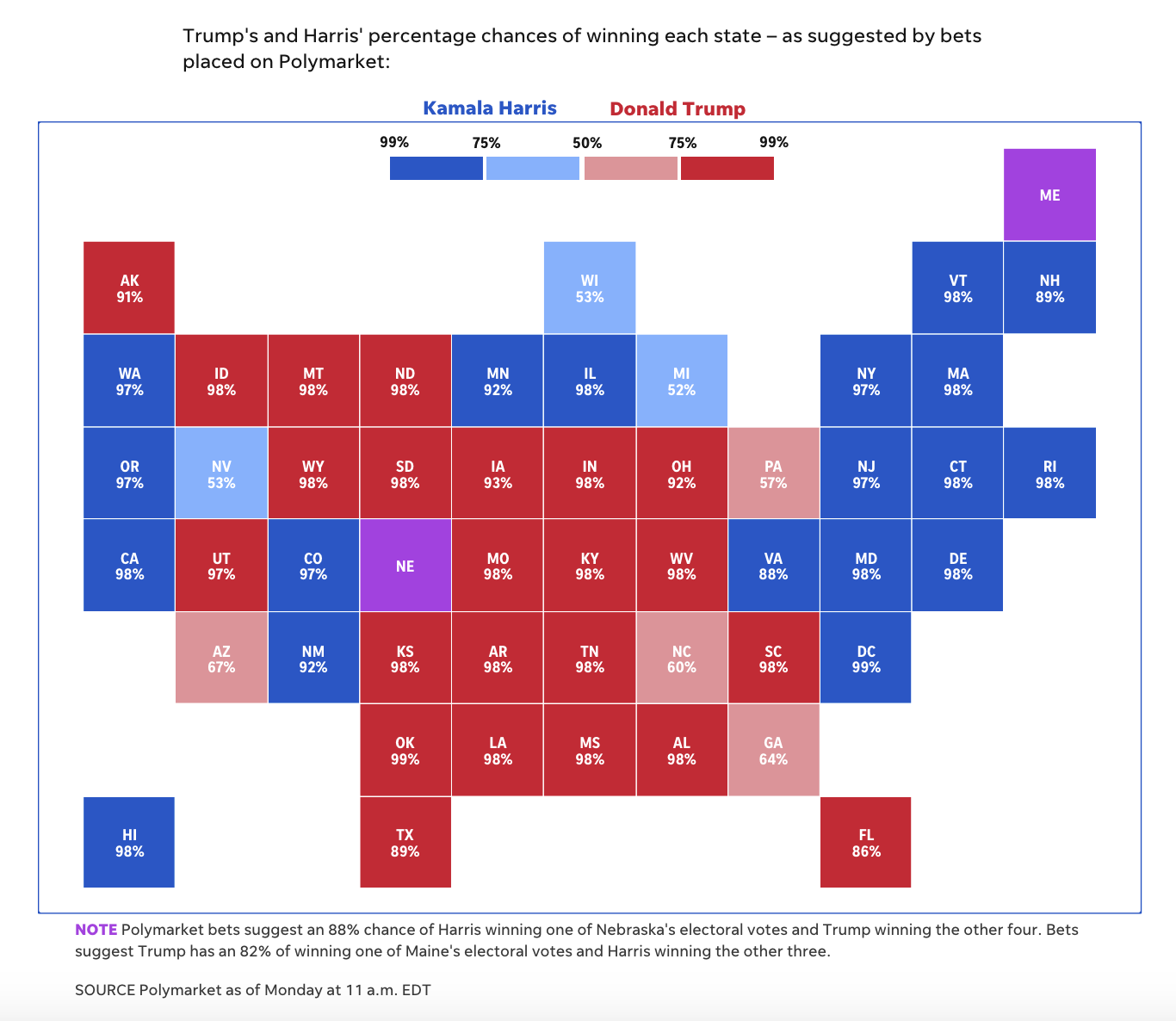

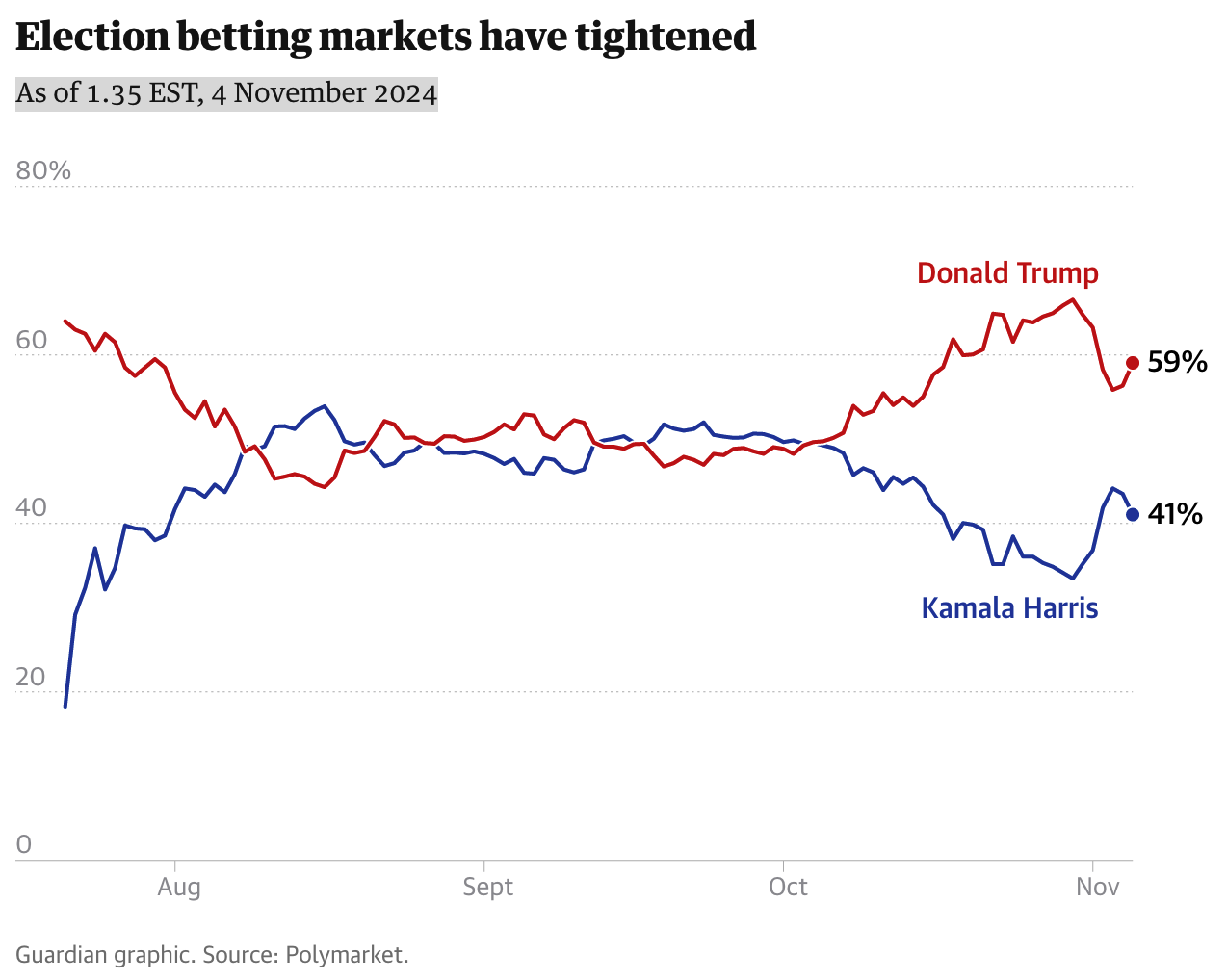

In the weeks leading up to the election, prediction markets presented a different perspective on Trump’s chances, often showing results that diverged from traditional polling. Samuel S.-H. Wang, a neuroscience professor at Princeton University, highlights that prediction markets can reflect “crowd wisdom,” capturing real-time data that might be missed by conventional polls.

Related: Bitcoin Braces For U.S. Election Impact: How Trump VS Harris Could Shape Cryptocurrency’s Future?

Supporters of prediction markets, including Dartmouth economist Eric Zitzewitz, argue that betting markets offer faster insights than polls, as the financial stakes motivate participants to act quickly. However, critics like Columbia’s Andrew Gelman caution that betting doesn’t always lead to accurate predictions, as traders’ decisions may be swayed by personal biases or financial gains.

“It would be naive for people to think that just because someone is putting money down that means they’re going to have more information. People make bad investments all the time.” – Andrew Gelman, statistics and politics professor at Columbia

This guy put his money where his mouth is https://t.co/ZcYngnbpIT

— Kalshi (@Kalshi) November 6, 2024