Amid stricter regulations and competition one of the India’s largest fin-tech company, PayTM faces loss in revenue. The company losses amounted to Rs. 550 Crore in Q4 while the estimated loss last year Q4 was Rs. 169 Crore.

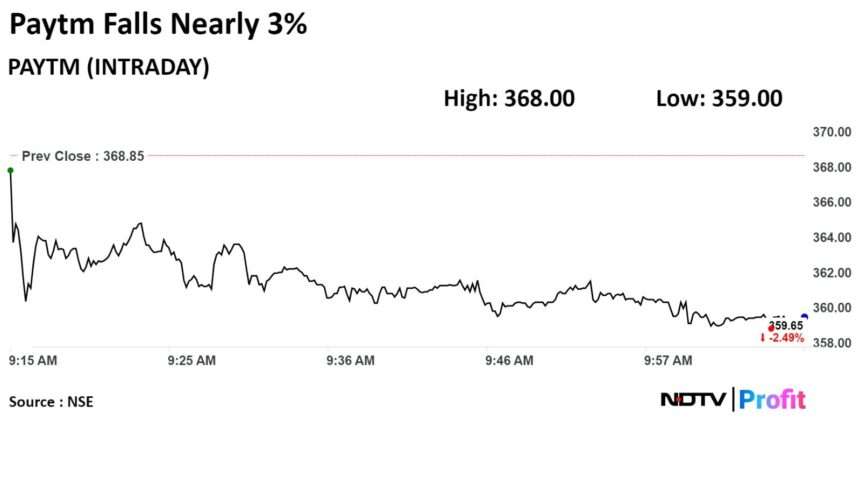

The revenue from its operations have been reported to fall by 3% Year Over Year (YOY) to Rs. 2267 crore compared to last year’s Rs.2334 crore. This loss in revenue is expected to follow if the actions are not taken within the company to minimize it next year.

The losses resulted from the adoption of Unified Payment Interface the instant payment system that is set to regulate fragmented mobile payment system and facilitate bank-bank and peer to peer transfer system that is regulated by Reserve Bank of India.

Another major reason is because of PayTM Payments Bank embargo after an inspection found that the company was leaking customer data to China-based entities which indirectly owned a stake in PayTM Payments Bank. The Reserve Bank of India ordered the Fintech company to stop all the operations in PayTM Payments bank from 15 March 2024. This led to cut of workforce as PayTM began suspending and terminating nodal accounts being maintained with PPBL.

Vijay Sekhar Sharma, the founder and managing director of PayTM’s Trade name ‘Company One 97 Communications PayTM Ltd.’ citing optimism said We demonstrated strong revenue momentum (up 25%) and continued our disciplined focus on, in spite of regulatory action on our associate entity, PayTM Payment Bank Ltd.,”

“FY 2024 has been a landmark year for the company as we achieved our first full year of EBITDA before ESOP profitability of Rs 559 crore.” – He added.

Paytm had launched their IPO in 2021 raising Rs. 18,300 crore at valuation of $20 Billion with Rs. 1950 per share. However it became the biggest drop in IPO listing in Single day in Indian history closing at Rs 1,560.

Start-Up And Origin of PayTM

PayTM started in 2010 as a private venture by Vijay Sekhar Sharma in Noida which still has its headquarters till this day. It raised the speculation of $2 million. Before entering payment services, they started on DTH recharge and prepared platform.

Their total mobile payment systems started in 2014 when Uber and Indian Railways added PayTM as their payment solutions. In 2015 they managed to get investment from Chinese conglomerate Ant Financial Services Group, an Alibaba Group Company (this later became a source of controversy in Indian Politics). They also received major investment from Ratan Tata the managing Director of Tata Sons, Mediatek’s Investment Fund Mountain Capital, Soft bank and Warren Buffet’s investment company Berkshire Hathaway invested $356 million for 4% of stake.

PayTM became the biggest fin tech company in India being the India’s first payments app reaching downloads over 10 Crore in 2017. PayTM is the market leader in mobile payment services. They have introduced many services to customers including basic merchant payment payments and long term savings through PayTM Gold. The company along with Gio leaped forward the Cashless Payments in india and Digitized the payment services. You can see the PayTM devices even on smaller merchants that help on cashless payments. They also introduced POS devices for ease of access.

They also expanded their services on Canada with PayTM Labs and in Japan with the joint venture with Softbank and ‘Yahoo!‘ Called PayPay.

Related: Ferrari Partners With HP For Multiyear Title Partnership Agreement

Controversies

The mobile payment services became a topic of controversy in Indian Community after it was revealed that they provided the The Jammu and Kashmir State’s customers’ Data to the government without consent, violating their own privacy policy. The revelation also showed that the founder had close relationship with Indian right-wing ruling party, BJP. The PayTM app was temporarily removed from Google play in 2020 due to violations of Google’s gambling policy on cashback offers.

In march 2022, the RBI banned PayTM payments banks under National security concern to signup new customers on signing up after it was revealed they have been sending customers private data to China based stake holders. Further on 2024, they were ordered to stop all PayTM payments bank operation for failing to properly verify sources of funds of new customers.

On 2016, a case was filed against PayTM by American Fin-tech company, PayPal for alleged violation of trademark using name and logo that was similar to PayPal. In its complaint for trademark opposition, PayPal contends that its brand name has been enlisted and used globally since 1999.

What’s forward

Throughout the turbulent history and successful palys, PayTM stands as the strongest and biggest Fin tech company in India withstanding the competition from likes of PhonePe, Google Pay, Apple. The short-fall of this year is the result of internal restructuring of the payment services and core ideology. It has been awarded as the “Employer of the Future” by Fortune India. Along with many genuine acts to help the people. They took major part in helping the citizens in Covid-19 pandemic, making various medical equipments available for hospitals.

PayTM continues to grow on one of the largest economies of the world and hopes to expand internationally.