Meet Inifnity – a Bengaluru based payment startup, has successfully closed a $1.9 million pre-seed funding round, with Silicon Valley accelerator Y Combinator. Alongside Y Combinator, Infinity has also closed pre-seed funding with two other investment firms; Liquid 2 Ventures and Script Capital.

The company aims to disrupt the $48 billion US-India payment corridor by addressing pain points faced by 250+ SMEs already using its platform.

The $3.9B Problem in Global Transactions

For every dollar moved between the US and India, businesses lose 3-5% to hidden fees and delays through traditional SWIFT networks. Founded by siblings Sourav and Sidharth Choraria, Infinity cuts costs by 70% using proprietary rails that bypass intermediary banks.

“Imagine paying $300 instead of $1,000 for a $20,000 transfer,” explains Sidharth, highlighting their flat-fee model with zero foreign exchange markup.

How Infinity’s Tech Stack Beats SWIFT

- Same-Day Settlements: Replaces 3-5 day SWIFT delays

- Multi-Currency Accounts: Manage USD, INR, EUR, GBP in one dashboard

- Treasury Solutions: Earn 6-8% APY on idle cash via government securities

- Compliance Automation: Instant RBI/FEMA-compliant remittance certificates

The platform has already processed ₹50 crore ($6M) in transactions since its 2023 launch.

Founders With Skin in the Game

The Choraria brothers bring deep fintech expertise:

- Sourav: Scaled Paytm Money to 20M users; launched India’s first FD-backed credit card

- Sidharth: Built Amazon Appstore’s in-app purchase system; engineered systems handling 100M daily requests

Their inspiration came from family experience. “Our father’s Kolkata-based manufacturing business lost weeks waiting for Chinese raw material payments,” shares Sourav. “Now we’re fixing this for 63 million Indian MSMEs doing global trade.”

Market Expansion & Regulatory Roadmap

With fresh capital, Infinity plans to:

- Obtain RBI’s cross-border payment aggregator license

- Expand partnerships with 10+ US/European banks

- Launch hedging tools for currency risk management

The startup joins YC’s growing India portfolio that includes Razorpay (valued at $7.5B) and Groww ($3B valuation).

Why This Matters for US Businesses

For American companies paying Indian contractors/vendors, Infinity offers:

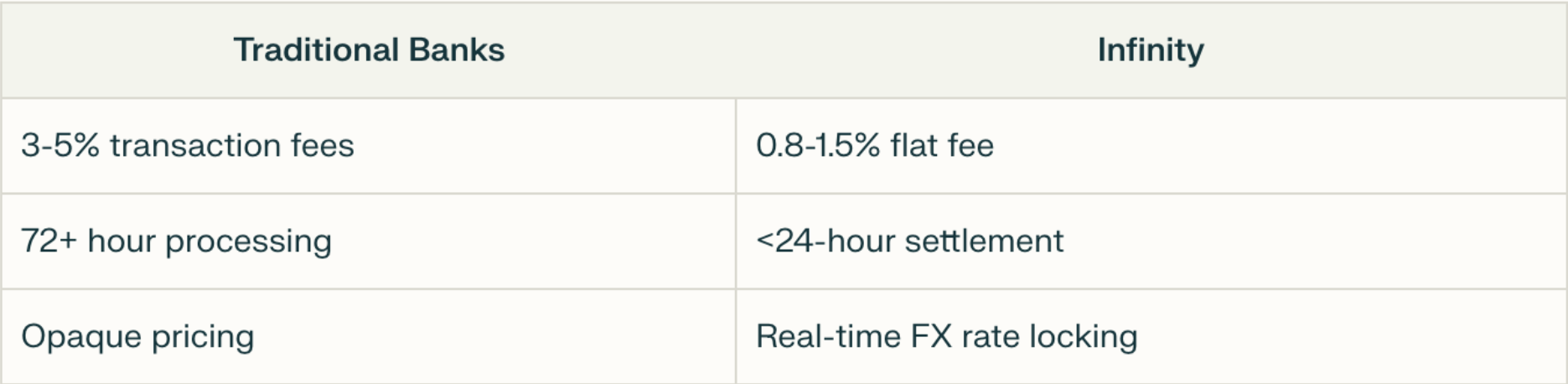

Difference Between Traditional Banks & Infinity

Early adopter Tyler Nguyen, CEO of a Texas-based SaaS firm, reports:

“We saved $12,000 last quarter while getting remittance docs in 2 clicks.”

Market Potential & Strategic Growth

With the US-India trade corridor projected to reach $500 billion by 2030, Infinity is positioning itself at the intersection of fintech and global commerce. The company plans to:

- Obtain RBI’s cross-border payment aggregator license by Q2 2025

- Launch multi-currency business accounts supporting USD, EUR and GBP

- Develop AI-powered tools for currency risk mitigation

Investors see particular promise in Infinity’s hybrid model. “They’re not just moving money – they’re building financial infrastructure for next-gen global trade,” notes Liquid 2 Ventures partner Michael Thompson. This sentiment echoes Y Combinator’s successful bets on Indian fintech leaders like Razorpay and Groww.

Looking Ahead:

As cross-border e-commerce between the US and India grows at 25% CAGR, Infinity’s Series A targeting Q3 2025 could position it as the Stripe for emerging market transactions.